아래 3월 포스팅 이후에, 주가 많이 하락되었다.

전기차에 대한 관심이 테슬라 주식이 폭발적으로

주가가 상승함으로 관심과 주목을 받았던 시기이기 때문에

미래 가치를 미리 가져온 것이라는 이야기들이 많다.

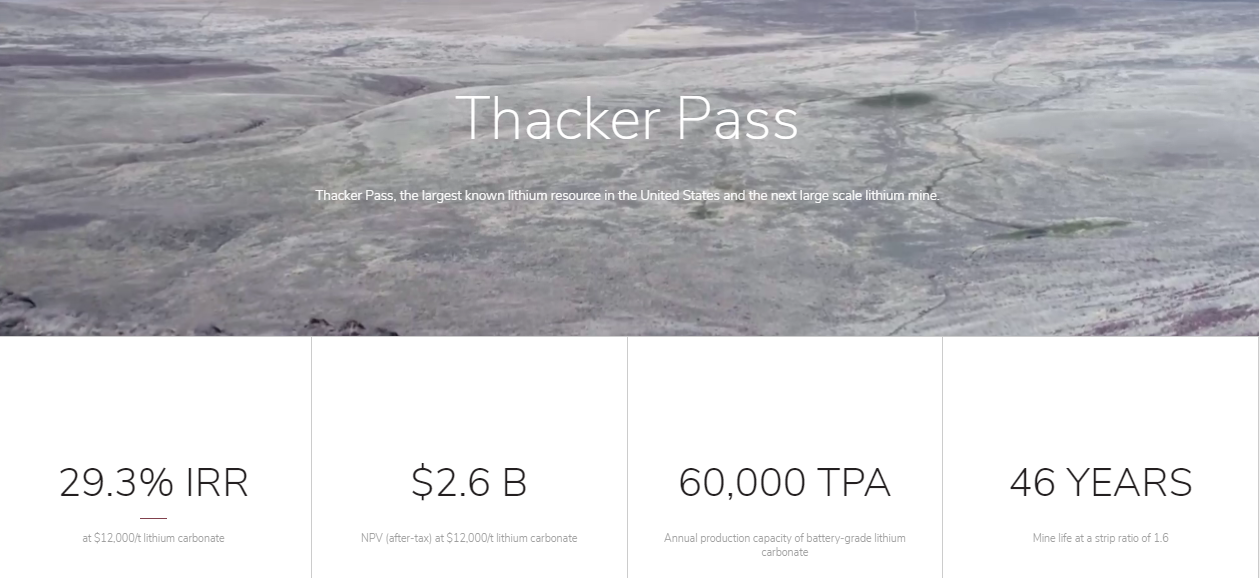

분명 LAC 는 네바다 사막에 광산 개발을

잘 진행하고 있는 것으로 보이면,

최근에 투자금도 잘 유치한 것으로 기억한다.

Thacker Pass 광산이 준비가 되고 리튬이 실질적으로 공급되게 될 때까지는

이 주식을 들고 있을 계획이다.

잠시 관심에서 멀어지고, 광산 개발에 있어

가시적인 성과가 보여질때까지는 크게

주가가 올라갈 일이 없을 것으로 예상되나,

곧 미 정부의 더 나아간 허가와 광산 개발이 진행되어

리튬이 생산되기 시작하면

그 때 제대로 기업이 인정 받지 않을까 생각하고

분할 매수를 지속적으로 진행할 계획이다.

리튬은 지난 몇년간 하락세에 있었고,

해당 필드에 대한 투자도 그렇게 크진 않았다.

하지만 지금은 내연기관 자동차는 점점 감소하고

각국의 정책이 환경 문제로 전기차 지원쪽으로 변경되고 있다.

이는 전기차 시대로 가는 과도기에 있으며,

곧 전기차 판매가 증가되고,

배터리는 보다 많은 수요를 요구하게 되어 있다.

이로 인한 배터리에 중요한 재료 중 하나인

니켈과 리튬은 분명 제 가치를 인정 받을 것이다.

이렇게 되면 결국 리튬의 가격은 상승하고

이는 리튬 광산을 소유한 회사에 분명 이익을 가져다 줄 것이다.

리튬 광산과 관련하여

곧 도래하는 이벤트는 아래와 같다.

이러한 이벤트를 통해 해당 산업의

전체적인 분위기를 읽고

지속적으로 관심을 두어야

보유하고 있는 주식을

지킬 수 있을 것이라 생각한다.

3월 2일에 발표된 지난해 리포트의

주요사항 정리를 아래와 같이 가져왔다.

Highlights

Caucharí-Olaroz Lithium Project (“Caucharí-Olaroz”):

- Construction activities at Caucharí-Olaroz continue to advance with enhanced COVID-19 health and safety protocols in place.

- Capital expenditures for the Project remain on budget with $477 million (84%) of the $565 million committed, including $388 million (69%) spent, as of December 31, 2020.

- Capital costs attributable to COVID-19 during the construction period, including costs for quarantine and extra camp capacity, are being assessed and now reported separate from the budgeted capital expenditures.

- Significant progress has been made on the lime plant, solvent extraction plant and lithium carbonate plant.

- The solar evaporation ponds are well advanced with sufficient brine inventory to support production ramp up.

- The health and safety of the workforce and surrounding communities remains the highest priority with no positive cases of COVID-19 reported at site in over 130 days.

- Based on the latest construction schedule, which assumes a reduced workforce at site in accordance with COVID-19 protocols throughout construction, the Company expects first production in mid-2022.

- In Q1 2021, Marcelo Cabral was appointed General Manager responsible for the development and commissioning of Caucharí-Olaroz. Mr. Cabral was previously with Gold Fields Ltd. and responsible for commissioning MMG Ltd.’s Las Bambas copper project in Peru.

- In H1 2021, the Jujuy Energia y Mineria Sociedad del Estado (“JEMSE”), a company owned by the Government of Jujuy province, is expected to complete the exercise of its 2012 participation right, at which point it will receive and hold an 8.5% interest in Caucharí-Olaroz.

Thacker Pass Lithium Project (“Thacker Pass”):

- On January 15, 2021, the US Bureau of Land Management issued the Record of Decision following completion of the National Environmental Policy Act process.

- All remaining state permits and water right transfers required to commence construction are expected later this year.

- The process testing facility in Reno, Nevada, continues to operate with enhanced COVID-19 protocols in place and has produced over 15,000 kg of lithium sulphate solution.

- The Company continues to evaluate partnership and financing opportunities for Thacker Pass, including the possibility of a joint venture partner.

- The Company contemplates that the feasibility study will include an initial production capacity greater than 20,000 tonnes per annum of lithium carbonate equivalent previously considered. Based on ongoing discussions with potential partners and customers, the Company expects that a finalized development plan and timeline of the related feasibility study will be determined as the prospective commercial arrangements are advanced.

Corporate:

- As at December 31, 2020, the Company had $148 million in cash and cash equivalents ($518 million as at February 28, 2021).

- On January 22, 2021, the Company closed an underwritten public offering of shares of its common stock and issued 18,181,818 common shares at a price of $22.00 per Common Share for gross proceeds to the Company of approximately $400 million (approximately $377 million net proceeds).

- On November 30, 2020, Lithium Americas completed an at-the-market equity program (“ATM Program”) and issued a total of 9,266,587 common shares from treasury for gross proceeds of approximately $100 million ($97 million net proceeds).

- As at December 31, 2020, the Company had $184 million in undrawn credit with $96 million drawn from the $205 million senior credit facility and $25 million from its $100 million unsecured, limited recourse, subordinated loan facility.

- In February 2021, Ignacio Celorrio was promoted to President, Latin America to act as the Company’s representative in Latin America and oversee the management of the Caucharí-Olaroz project.

- In November 2020, Lithium Americas published its inaugural 2019 Sustainability Report prepared with reference to the Global Reporting Initiative Standards, which includes reporting on the United Nations’ Sustainable Development Goals.

Financial Results

Selected consolidated financial information is presented as follows:

| (in US$ million except per share information) | Year ended December 31, 2020 | Year ended December 31, 2019 |

| $ | $ | |

| Expenses | (30.6) | (15.7) |

| Net (loss)/income | (36.2) | 51.7 |

| (Loss)/income per share - basic | (0.39) | 0.58 |

| (in US$ million) | As at December 31, 2020 | As at December 31, 2019 |

| $ | $ | |

| Cash and cash equivalents | 148.1 | 83.6 |

| Total assets | 326.7 | 293.8 |

| Total long-term liabilities | (127.3) | (119.2) |

'[INVESTMENT][투자] > [US Stock][미국 주식]' 카테고리의 다른 글

| [LAC] 리튬 어메리카스 최신소식 Lithium Americas Announces Investment in Arena Minerals Inc. (0) | 2021.07.13 |

|---|---|

| [Lithium Americas] Cauchari-Olaroz 에서 확장계획 시작 (0) | 2021.05.31 |

| [LAC] 3월 31일 주가 상승 이유 (0) | 2021.04.01 |

| [LAC] 2021년 3월 3일 주가 하락 이유 (0) | 2021.03.04 |

| Lithium Americas Reports 2020 Full Year and Fourth Quarter Results (0) | 2021.03.02 |